*** Watch Sarah discuss this bill on Tiktok or our Substack, or listen to the discussion on our Podcast: BillTrack50 Beyond the Bill Number on Apple Podcasts, Spotify, YouTube or where ever you get your podcasts ***

This week we'll be looking into a bill aimed to update the Supplemental Security Income (SSI) program (which hasn't been updated in almost 40 years!). We'll look at what this program is, why many believe an update is needed, and what the legislation would do.

What is the Supplemental Security Income program?

The Supplemental Security Income (SSI) program is a US federal assistance program designed to provide financial support to disabled and older individuals with limited income and resources. It was created in 1972. SSI is one of the two programs administered by the Social Security Administration, the other, distinct program, is the Social Security Disability Insurance (SSDI) program. SSDI provides benefits to disabled individuals based on their work history and contributions to the Social Security system. Amounts received by individuals under SSDI are variable, as they are based upon past earnings. SSI is meant for individuals who do not qualify for SSDI, usually because they have not worked enough time to qualify for SSDI benefits.

SSI is a need-based program, and eligibility is determined by the individual's or household's income and resources. The program aims to assist those who have limited financial means and resources to meet basic needs. To be eligible, individuals must have: little or no income, little or no resources, and a disability, blindness, and/or be 65 or older. The program also considers applicants based on citizenship and residency status.

Key features of SSI include:

- Variable Monthly Payments: Qualified individuals receive monthly cash payments from the government to help cover the costs of basic living expenses including: food, shelter, and clothing. The SSI payment amount is influenced by factors like other income sources and living arrangements.

- Medical Eligibility: Individuals who apply for SSI benefits may be required to undergo a medical evaluation to determine their disability status. The program considers both the severity of the disability and its impact on the individual's ability to work.

- State Supplements: Some states (like California, Delaware, DC, Hawaii, Iowa, Michigan, Montana, and Nevada) may provide additional supplements to the federal SSI payment to further assist eligible individuals. These supplements vary by the state and are meant to address different costs of living across the country.

The Supplemental Security Income program plays a crucial role in supporting disabled individuals who may face financial challenges due to their circumstance. The program is designed to provide a safety net for those with limited income and resources, helping them maintain a basic standard of living and access necessary medical care.

What impacts SSI amounts?

Each month, individuals part of SSI must report their wages, other income, and changes to their resources or living arrangements. The maximum SSI monthly payment for 2023 was $943 for an individual and $1,415 for a couple. Program members' amounts may be lower based on factors like income, family members’ income, and living situation.

SSI payments are reduced by around $1 for every $2 earned from work (a job, self-employment, or any other money earning activity). Also, money from non-work sources (disability benefits, unemployment payments, pensions) lower payments by around $1 for every $1 received.

If an individual lives in someone else’s home, their SSI may be lowered by up to a third of the year’s maximum payment. This reduction doesn’t apply if they live with someone else and pay their "fair share" of food and shelter costs. Fair share is explained as such: If you live somewhere with four people and the monthly living costs are $1600, you must pay at least 1/4th, or $400, a month to not have the one-third reduction rule applied.

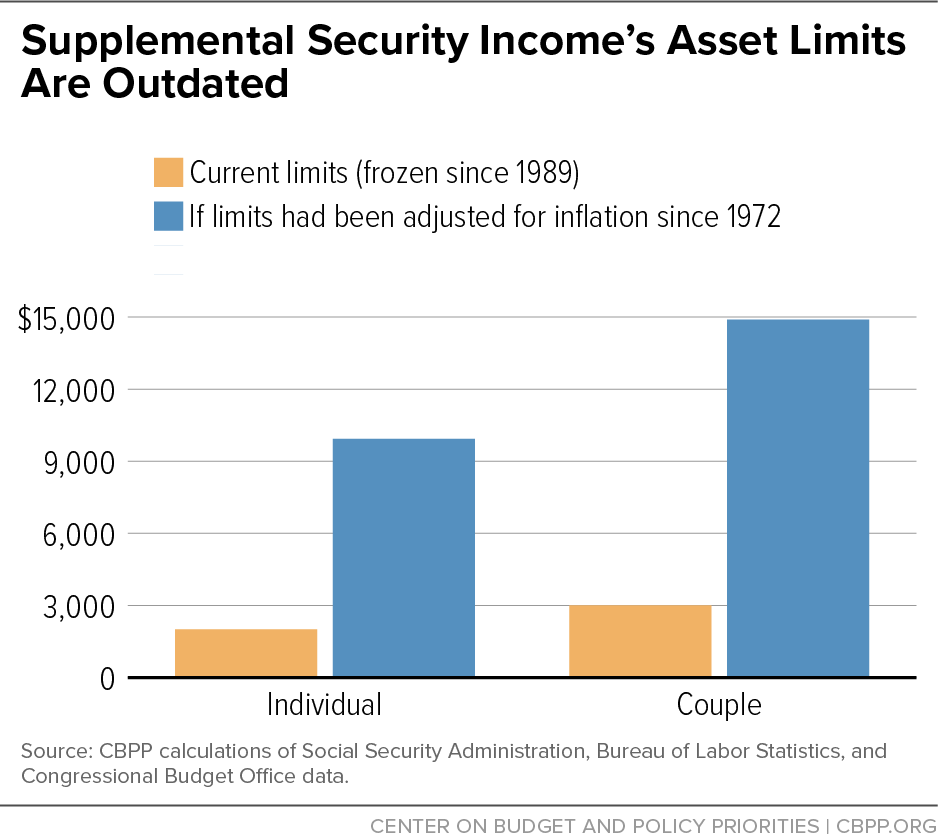

Currently, individuals receiving SSI benefits are limited to $2,000 in assets and married couples are limited to $3,000. One interesting piece of the program is this marriage penalty (the couple limit is 25% less than the limit for two individuals). Resources that count towards the asset limit include: cash, bank account balances, retirement accounts, mutual funds, stocks, bonds, life insurance policies, burial funds over $1,500, household goods, and other personal property. Anyone exceeding the limit, which has not been adjusted in decades, is immediately disqualified from the program and stops receiving benefits. The heart of this bill comes from the fact that having such low limits on the ability to save impacts an individual's ability to prepare for financial emergencies and for older Americans to retire.

What does this bill do?

The SSI Savings Penalty Eliminate Act (Senate bill) is a bipartisan bill (also supported by over 370 organizations) aiming to update the SSI asset limit for the first time since 1989. The resource limits were updated from the original 1972 values of $1,500 for individuals and $2,250 for couples to the current values back in the 1908s. The changes outlined in the legislation aim to ensure disabled and elderly Americans are able to prepare themselves for financial emergencies without putting the benefits they rely on at risk. The SSI Savings Penalty Elimination Act raises these caps to $10,000 for individuals and $20,000 for married couples. The bill will also index the limits to inflation moving forward, hopefully avoiding issues like this in the future.

House Bill Sponsor, Congressman Brian Higgins, said, “SSI was established to be a safety net for disabled Americans, but the program’s outdated, existing asset limits make it impossible for those on SSI to put away savings and provide for their families. This bill makes commonsense updates to SSI to prevent individuals with disabilities from being penalized for wanting to work and affords them the economic security they deserve.”

The Center on Budget and Policy Priorities had some really interesting findings related to reducing these limits and as well as what impact excluding additional categories of resources in the limit amount could have. CBPP found that increasing SSI resource limits to $10,000 per beneficiary would increase overall SSI participation by up to 3% (aka, allowing 3% of people who lost their eligibility to become eligible once again). Increasing limits to $100,000 per beneficiary (50x) would increase participation by around 5%. If lawmakers chose to eliminate limits altogether, participation could be increased by up to 6%. From another angle, if lawmakers chose to exclude retirement accounts from the overall limit, the impact would only be a slight increase to participation. Because SSI beneficiaries must have very low incomes or a disability that limits them to qualify, many have little margin for saving.

Conclusion

Allowing people the opportunity to try to save more does not have a serious impact on program participation, and thus will not cost the government an exorbitant amount more to run. It does, however, leave beneficiaries unable to save for unexpected expenses without endangering their qualification. This bill is a good step forward in helping people plan for their future, as well as the unexpected.

Cover Photo by Towfiqu barbhuiya on Unsplash

See more from The Center on Budget and Policy Priorities' study here: https://www.cbpp.org/research/social-security/the-case-for-updating-ssi-asset-limits

About BillTrack50 – BillTrack50 offers free tools for citizens to easily research legislators and bills across all 50 states and Congress. BillTrack50 also offers professional tools to help organizations with ongoing legislative and regulatory tracking, as well as easy ways to share information both internally and with the public.