This week we'll be taking a closer look at the MORE (Marijuana Opportunity Reinvestment and Expungement) Act. Many of us may have thought the news on April 1st that the House passed legislation to decriminalize cannabis at the federal level was an April Fools joke, but it was not. As a reminder, we've covered the topic legalization or decriminalization of cannabis in the past, here are a couple of our more recent posts: Marijuana Legalization, Criminal Justice Reform, and our Long Overdue Reckoning — Guest post by NORML, Let’s do marijuana legalization the right way — a closer look at KY HB 136 and SB 80, Colorado Gov Given Power to Expunge Marijuana Crimes, 8 Years after State Legalization, and Sessions versus Marijuana: What Are His Options?. This week, a closer look at legislation that could have national implications.

What does the MORE Act do?

The MORE Act was first passed by the House in December 2020 and it was read twice and referred to the Committee on Finance in the Senate. The Senate did not give the MORE Act a hearing or a vote in 2020. This year, the MORE Act was filed again, and passed out of the House just a few weeks ago on April 1st.

For the last 52 years, cannabis has been a Schedule 1 Controlled Substance (drugs with no currently accepted medical use and a high potential for abuse) on the federal level. In recent years, cannabis has become legal for medical use in 36 states and for adult, recreational use in 19 states. If this cannabis decriminalization bill is passed by the Senate, three key areas of marijuana/cannabis legality would be impacted:

- Cannabis would be removed from the list of drugs regulated by the Controlled Substances Act

- Criminal penalties for federal cannabis offenses would be eliminated

- Past federal cannabis convictions would be expunged

An important note is the MORE Act does not legalize cannabis, this would still be left up to the states to decide (similar to the way alcohol is federally regulated). The MORE Act simply decriminalizes it by ending the federal ban (removing it from list of federally controlled substances) and removing associated federal penalties.

The MORE Act uses the many states that have legalized cannabis over the past decade as a blueprint and would impose a popular tax on cannabis sales. Under the current version of the bill, the tax will start at 5% but increase to 8% over three years. The tax will be imposed on the retail sales of cannabis and proceeds from the tax will to go to a newly established Opportunity Trust Fund. This tax would be collected by the new governmental organization, the Cannabis Justice Office, which would be tasked with overseeing the social equity provisions of the MORE Act.

The Opportunity Trust Fund would divvy up their tax earnings: 50% would support a Community Reinvestment Grant Program, 10% would support substance misuse treatment programs, and 40% would go to the federal Small Business Administration to support implementation and a newly created equitable licensing grant program. The Community Reinvestment Grant Program would provide eligible entities with funds to administer services for individuals adversely impacted by the War on Drugs. Some of these services include job training, reentry services, legal aid for civil and criminal cases (including expungement of cannabis convictions), literacy programs, youth recreation or mentoring programs, and health education programs.

The MORE Act would also ensure the federal government could not discriminate against people because of cannabis use. It would protect people from losing earned benefits due to cannabis use or protect immigrants at risk of deportation. The bill would also open the door to research. Because cannabis is technically still illegal at a federal level, it is still technically illegal to medically research cannabis. There are many scholarly articles related medical benefits of cannabis ranging from cancer treatments, to mental health aides, to dermatology use cases.

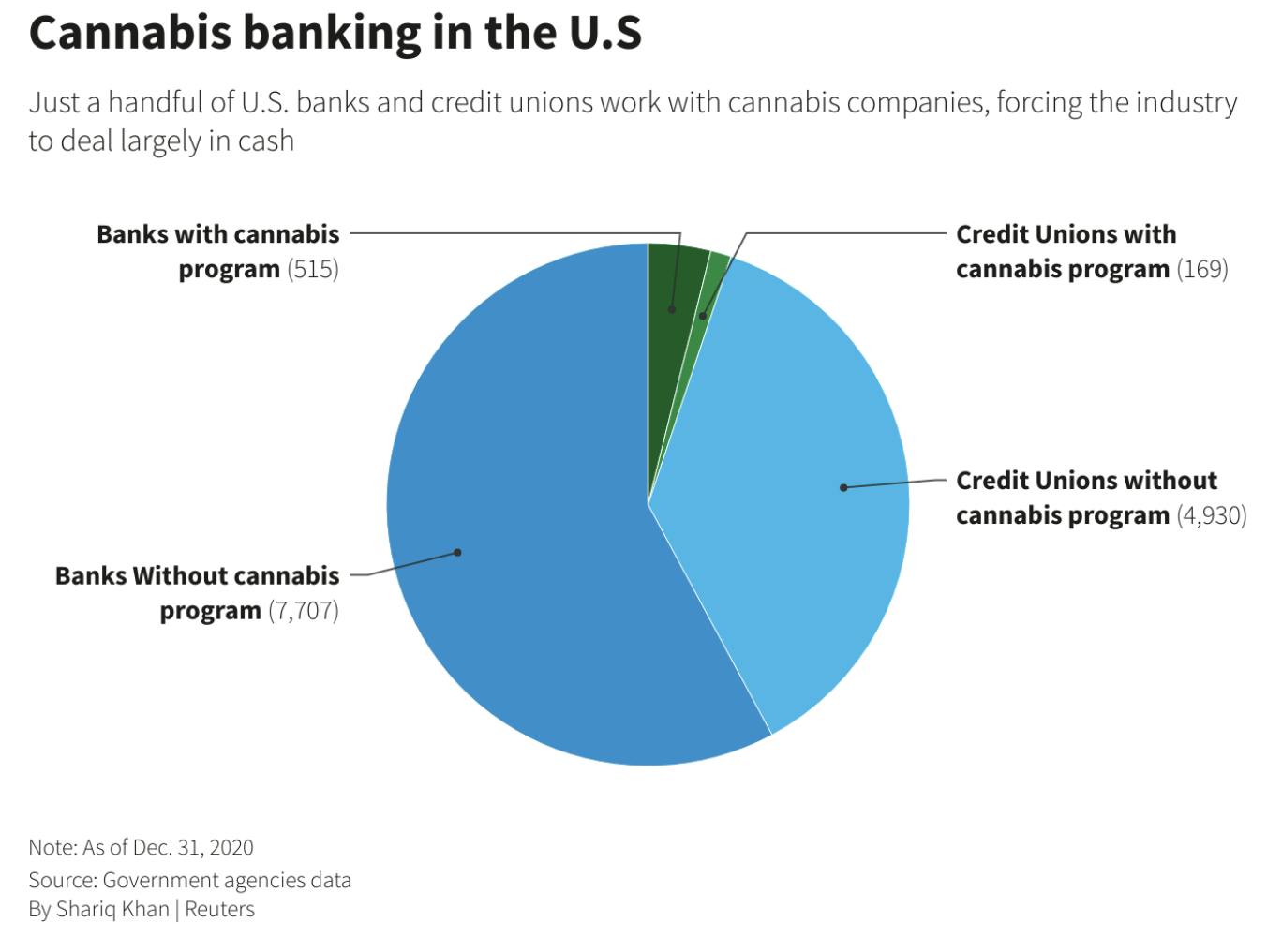

Finally, decriminalizing cannabis would allow cannabis providers to practice safer business practices and partake in federally regulated business activities. One main focus here is cannabis related business would finally be able to use federally mandated banks as normal businesses instead of having to pay a premium for banking services from select banks offering cannabis programs. According to Reuters, only 7% of banks and 3% of credit unions offer a cannabis program, and some charge 400x more for a cannabis business account than their usual business banking accounts.

Businesses that do choose to bank with a business who offer a cannabis program have to pay whatever premium banks impose. This is for two reasons, one, there are not many banks that take on cannabis related banking, and two, the federal illegality of cannabis increases the amount of paperwork and oversight needed by banks.

Other business practices that could become available to cannabis companies if this passes is advertising on Google ads, sending business related SMS, leveraging social media for advertising, and more.

Not surprisingly, the House vote fell largely along party lines. Only three Republicans, Brian Mast, Tom McClintock, and Matt Gaetz, supported the measure. Two Democrats, Henry Cuellar and Christopher Pappas, opposed the MORE Act. Five representatives, Ted Budd (R), Cheri Bustos (D), Liz Cheney (R), Mike Johnson (R), and Lee Zeldin (R), did not vote.

What is being said about the possibility of the MORE Act passing in the Senate?

The MORE Act will need 60 votes to pass the Senate, meaning the majority of Democrats and 10 or more Republicans. A few Senators have voiced their opinion on the legislation, even though the bill has not been picked up yet.

Senator Elizabeth Warren said, “I don’t use it, but I believe it should be lawful. We need to regularize our banking laws and our tax laws around a business that will bring in billions of dollars for users and take a lot of risk out of a system right now that is legal in some places, but illegal at the federal level, and it makes no sense.”

Sen. Lindsey Graham said he doesn’t support legalizing marijuana but does see “value” and “legitimacy” in medical cannabis.

Senator James Lankford said “I understand the House is going to try and skip the science and say we’re not going to look into that because people use it; we’re just going to allow it,” said Lankford. “But increasing the use of cannabis doesn’t make our streets safer, doesn’t make our workplaces safer; it doesn’t make our families stronger.”

Other Statements

Congressional candidates Texas Jessica Cisneros, Pennsylvania, John Fetterman, to Indiana, Thomas McDermott, have released statements in support of the MORE Act and highlighting their adversaries lack of support.

Senator Cory Booker said "Right now we’re looking at doing the one that we’ve been working on for a long time" referring to the CAO act. He followed up this statement with "It’s just very encouraging that there is an appetite not just to decriminalize at the federal level, but really do restorative justice — things that are very important."

What's The Cannabis Administrative and Opportunity Act?

The Cannabis Administrative and Opportunity (“CAO”) Act, the Senate's comprehensive marijuana bill, has yet to be filed in 2022. The bill is sponsored by Senate Majority Leader Chuck Schumer, Senator Cory Booker, and Senator Ron Wyden. This bill, similar to the MORE Act, would remove marijuana from the Controlled Substances Act and allow states to determine their own cannabis laws. The first draft of the CAO had a 10% cannabis sales tax increasing to 25% over 5 years, much higher than the 5-8% proposed in the MORE Act. The revenue generated by this federal tax would fund support restorative justice, public health programs, and safety research.

Would Biden sign a passed MORE Act?

When asked about the MORE Act, White House Press Secretary Jen Psaki said President Joe Biden agrees with most Democratic lawmakers that “our current marijuana laws are not working,” but did not specify if Biden supports the MORE Act.

Psaki when on to say “As the president said during the campaign, our current marijuana laws are not working. He agrees that we need to rethink our approach, including to address the racial disparities and systemic inequities in our criminal justice system, broaden research on the effects of marijuana and support the safe use of marijuana for medical purposes.” She then added “We look forward to working with Congress to achieve our shared goals and we’ll continue having discussions with them about this objective.”

Final Thoughts

Cannabis decriminalization is not going away and it is time we address the "elephant in the room" at a national level. The 10 year anniversary of recreational legalization for Colorado and Washington is coming up this fall and we have fallen short addressing this as a country. Just last year, "legal" US cannabis sales grew 30% to $22 billion last year, surpassing the amount Americans spent on wine, according to data from Euromonitor. Sales are expected to continue to rise this year.

All states that have "legalized" cannabis over the last 10 years still technically are breaking the law due to preemption. Because of this, this industry faces huge obstacles (think back to the banking laws), and Americans are still paying to price of outdated penalties for cannabis use.

Many people are worried that the competing interests between the MORE and COA Acts could create an unnecessary deadlock. In my opinion, and looking our our politics right now, I feel like they are right. We absolutely do not need to leave the cannabis industry, or every day Americans, with another year of failed reforms.

Cover Photo by manish panghal on Unsplash

About BillTrack50 – BillTrack50 offers free tools for citizens to easily research legislators and bills across all 50 states and Congress. BillTrack50 also offers professional tools to help organizations with ongoing legislative and regulatory tracking, as well as easy ways to share information both internally and with the public.